Off-Plan Properties A Complete Guide to Modern Real Estate Investments

Off-plan properties have become a rising trend in real estate markets worldwide. They allow buyers to purchase homes or apartments before construction is completed, often directly from developers. This approach provides unique opportunities for investors and homebuyers alike, offering lower entry prices, flexible payment plans, and the chance to customize future homes.

While off-plan property investment carries certain risks, it has become a popular strategy in high-growth cities across the globe. Developers use modern technologies and transparent processes to enhance buyer confidence, making this sector one of the fastest-growing in real estate.

This guide will explore the concept of off-plan properties, their benefits, risks, real-world examples, and how technology is transforming the experience.

What Are Off-Plan Properties?

Off-plan properties refer to real estate developments sold before construction is finished. Buyers secure ownership by purchasing directly from the developer, often using staged payment plans that align with the project timeline.

This approach offers benefits such as discounted prices compared to completed properties and the ability to choose specific layouts or finishes. However, it also requires trust in the developer, as buyers commit to a project based on architectural plans, 3D renders, and show homes rather than physical units.

Off-plan properties can include residential apartments, villas, and even mixed-use developments. Their popularity is highest in dynamic urban hubs where real estate demand exceeds supply.

Why Off-Plan Properties Are Gaining Popularity

Off-plan properties are increasingly attractive to investors and end-users.

One of the key reasons is affordability. Developers often provide early-bird pricing, making off-plan properties cheaper than finished homes in the same location. Additionally, flexible payment schemes-such as paying installments during construction-allow buyers to plan financially without the immediate need for a full mortgage.

Another factor is the potential for property appreciation. In rapidly developing cities, values of off-plan properties often rise significantly by the time construction is completed, creating attractive returns for early investors.

Benefits of Off-Plan Properties

Off-plan investments are appealing for several reasons beyond price.

Lower Entry Prices

Buying early in a project often means securing properties at below-market rates. As construction progresses, values typically increase, benefiting early adopters.

Customization Options

Many developers allow buyers to personalize their units. This could include choosing layouts, materials, or interior finishes, giving homeowners a sense of individuality and control.

Flexible Payment Plans

Instead of paying the full price upfront, buyers can follow construction-linked payment schedules. This provides financial breathing room compared to immediate full-cost purchases.

Potential for High Returns

In thriving real estate markets, off-plan buyers often enjoy capital appreciation before construction is completed, making it a strong investment strategy.

Modern Facilities and Design

Off-plan projects are often built with the latest architectural trends, sustainability standards, and technology integration, ensuring long-term value.

Real-World Examples of Off-Plan Properties

To illustrate how off-plan properties work in practice, let’s explore global examples of successful projects.

1. Emaar Beachfront (Dubai, UAE)

Dubai is one of the world’s most vibrant markets for off-plan properties, and Emaar Beachfront stands as a prime example. Developed by Emaar Properties, this master-planned community offers luxury waterfront apartments with private beach access.

Buyers are drawn to the development because of its strategic location, high-quality design, and strong developer reputation. Many investors have seen significant appreciation in value even before completion, showcasing why Dubai remains a hotspot for off-plan real estate.

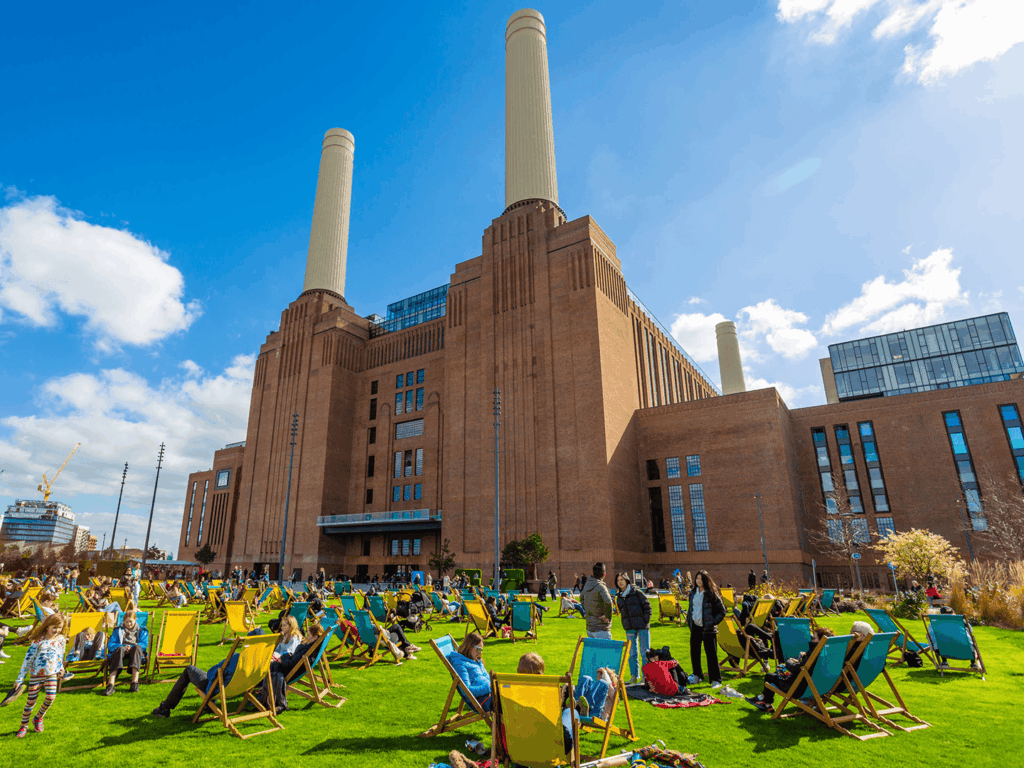

2. Battersea Power Station Redevelopment (London, UK)

One of the most ambitious regeneration projects in Europe, Battersea Power Station combines historic architecture with modern design. Buyers were able to purchase luxury apartments years before completion, securing units in one of London’s most iconic landmarks.

This project illustrates how off-plan investments can be linked with cultural and urban regeneration, offering not just housing but also lifestyle, retail, and business opportunities.

3. One Sydney Harbour (Sydney, Australia)

Lendlease’s One Sydney Harbour is a premier off-plan residential development in Barangaroo, Sydney. It offers high-rise luxury apartments overlooking the harbor, with designs by world-renowned architects.

Buyers were able to secure apartments during early sales phases, many of which increased in value significantly before completion. This project highlights how off-plan investments thrive in cities with high demand and limited prime land availability.

4. The Ellinikon Project (Athens, Greece)

The Ellinikon is Europe’s largest urban redevelopment project, transforming the old Athens airport into a futuristic city. Buyers of off-plan residences here not only gain luxury homes but also access to a sustainable city concept with green spaces, smart technologies, and integrated communities.

This example demonstrates how off-plan projects are evolving to include entire smart cities, not just residential towers.

Use Cases of Off-Plan Properties

Off-plan properties serve different types of buyers and investors.

For Investors

Investors use off-plan purchases to secure properties at a lower cost, then sell them at higher prices once construction is complete. In high-growth markets, this strategy yields strong capital gains.

For First-Time Buyers

Off-plan projects often provide more affordable entry points for first-time buyers, who can benefit from staged payments and modern amenities that may not be available in older housing.

For Expats and Global Buyers

In cities like Dubai, London, and Singapore, off-plan properties attract international buyers seeking second homes or investment opportunities in stable real estate markets.

For Developers

Selling units off-plan allows developers to secure financing during construction, ensuring smoother project execution and financial stability.

Technology in Off-Plan Properties

Technology has become crucial in the off-plan sector, addressing one of its biggest challenges: buyer confidence.

Virtual Reality Tours

Developers now use VR and 3D rendering to give buyers immersive experiences of properties before construction. This reduces uncertainty and enhances trust.

Blockchain for Transactions

Blockchain technology is being adopted to secure real estate contracts, ensure transparent payment tracking, and prevent fraud in off-plan sales.

Smart Construction Technologies

Developers use AI-driven planning, prefabrication, and sustainable construction methods to ensure timely delivery and high build quality.

Digital Platforms for Buyers

Many developers have mobile apps and portals where buyers can track construction progress, view milestones, and communicate with project managers in real-time.

Risks of Off-Plan Properties

While off-plan properties have clear advantages, they also come with risks that buyers must understand.

Construction Delays

Projects can face delays, which may extend handover timelines and affect investment returns.

Market Fluctuations

If property values decline before completion, buyers may not achieve expected returns.

Developer Reliability

Choosing the wrong developer can lead to financial loss if projects are poorly executed or abandoned.

Financing Risks

Some buyers may struggle with mortgage approval upon completion, particularly if market conditions change.

Frequently Asked Questions

Q1. What is the main advantage of buying an off-plan property?

The main advantage is securing a property at a lower price compared to completed homes, with flexible payment options and strong potential for capital appreciation.

Q2. What are the risks of off-plan property investment?

Risks include construction delays, market fluctuations, and developer reliability. Buyers should research thoroughly before committing to a project.

Q3. How does technology help in off-plan property purchases?

Technology provides virtual tours, blockchain-secured contracts, and real-time construction updates, all of which increase transparency and buyer confidence.